Wealth Without Walls: Build Smarter Returns, Not Bigger Risks

Money works best when it’s moving with purpose—not panic. Yet millions still chase returns like storms, ignoring the quiet power of structure and patience. What if growing wealth wasn’t about picking winners but designing systems? Behind every lasting portfolio isn’t a stroke of luck, but a framework: clear goals, disciplined allocation, and risk managed before it strikes. This isn’t about get-rich-quick schemes or volatile bets. It’s about making money that lasts—through cycles, surprises, and time. Here, we unpack how smart finance balances gain with guardrails, transforming effort into endurance.

The Return Puzzle: What You’re Actually Paying For

When investors talk about returns, they often focus on the headline number—the percentage gain on their account statement over a quarter or year. But this surface-level view hides a deeper truth: what you earn is not what you keep, and what you keep is not always what you need. True return should be measured not in dollars gained, but in purchasing power preserved. A 7% annual return sounds impressive—until inflation runs at 5%. Suddenly, your real gain is just 2%. That gap determines whether your savings will stretch through retirement or fall short when you need them most.

Historical data underscores this reality. From 1980 to 2000, the S&P 500 delivered an average annual return of about 11%. Over the same period, inflation averaged roughly 3.2%. This left investors with a real return—adjusted for cost of living—of around 7.8%. Fast forward to the 2000s, where despite volatile markets, the long-term compounding effect still rewarded those who stayed in. But many didn't. Behavioral studies show that the average mutual fund investor earned far less—just 6.3% annually between 2004 and 2023—because they bought high and sold low. Their accounts grew, but their actions eroded net results. The gap between the market’s return and the investor’s return is often the result of emotional timing, not financial underperformance.

Returns are composed of three key elements: yield (income like dividends or interest), capital appreciation (price growth), and inflation (the silent clawback). Understanding these components allows for smarter expectations. A bond yielding 4% in a 2% inflation environment offers modest but stable real growth. A tech stock surging 30% might dazzle—but without earnings growth or cash flow to support it, that surge could vanish as quickly as it appeared. Real wealth isn’t built on volatility, but on sustainable value accumulation. This shift in perspective—from chasing numbers to evaluating substance—marks the first step toward financial clarity.

It’s also critical to dispel the myth that higher returns mean better outcomes. High returns often come with high risk, and the cost of a single severe loss can erase years of gains. For example, a 50% portfolio loss requires a 100% gain just to break even. Many investors overlook this mathematical reality, seduced by stories of explosive growth. Past performance, while informative, is not predictive. Funds that topped the charts in one decade often lag in the next. The key insight is this: consistent, moderate returns with low volatility often outperform erratic high flyers over time, especially when taxes, fees, and emotional decision-making are factored in.

Risk Redefined: Your Hidden Financial Shadow

Risk is widely misunderstood. Most people equate risk with market volatility—the daily ups and downs of stock prices. But true financial risk is not the fluctuation of portfolio value; it is the permanent loss of capital or the failure to meet essential financial goals. The real danger isn’t watching your account dip temporarily; it’s retiring with $500,000 instead of the $1 million you needed, or depleting savings during a medical crisis. These are irreversible outcomes that no market rebound can fully repair.

One of the most underappreciated dangers is sequence-of-returns risk, particularly for those nearing or in retirement. This refers to the impact of market performance in the early years of withdrawal. A retiree who experiences a 25% market drop in the first year of drawing income may never recover, even if markets rebound strongly in later years. Why? Because they are selling assets at depressed prices, reducing the base available for future growth. Studies show that retirees who experienced poor market conditions early in retirement had a significantly higher chance of running out of money—even if long-term market averages were favorable.

Other forms of risk include concentration, where too much wealth is tied to a single stock, sector, or asset class. Employees who hold large positions in their company’s stock—especially if it’s also their employer—face dual exposure: job and investment. If the company struggles, both income and savings suffer simultaneously. Leverage, or borrowing to invest, amplifies risk exponentially. A 10% decline in a leveraged position can lead to a 20%, 30%, or even 100% loss, depending on the debt level. Illiquidity is another silent threat—investments that can’t be easily sold when cash is needed, such as private equity or real estate without clear markets.

To manage risk effectively, investors must distinguish between risk capacity and risk tolerance. Risk capacity is objective: How much financial loss can you absorb without derailing your goals? It depends on age, income stability, emergency savings, and time horizon. A 35-year-old with a stable job and decades until retirement has high risk capacity. A 65-year-old living off savings has far less. Risk tolerance, on the other hand, is emotional—how much volatility can you endure without panic-selling? Many assume these are the same, but they’re not. Someone may claim to be aggressive but sell everything during a 15% dip. Aligning portfolio strategy with actual risk capacity—not just perceived tolerance—protects against irreversible setbacks.

Diversification Done Right: Beyond the Buzzword

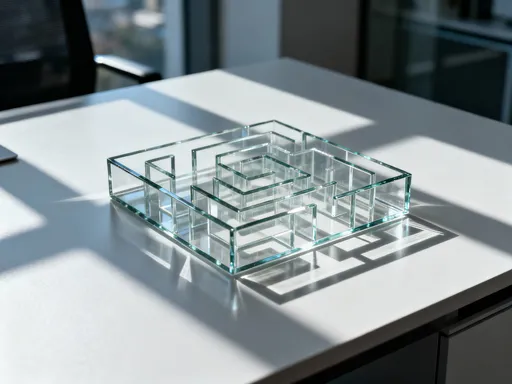

Diversification is one of the most repeated concepts in investing, yet it is also one of the most poorly executed. The common advice—“don’t put all your eggs in one basket”—is accurate but incomplete. True diversification isn’t just spreading money across different stocks or funds; it’s engineering resilience through strategic exposure to uncorrelated or negatively correlated assets. When one part of the portfolio struggles, another can hold steady or even gain, reducing overall volatility without sacrificing long-term growth.

A classic example is the traditional 60/40 portfolio—60% in stocks, 40% in bonds. While this mix seems simple, its power lies in how the two asset classes interact. During the 2008 financial crisis, U.S. stocks fell nearly 38%, but long-term government bonds rose over 25%. The combined portfolio dropped less than 20%, cushioning the blow. In 2020, during the pandemic-driven crash, stocks plunged but bonds again provided stability. Even in 2022, when both stocks and bonds declined—a rare event due to high inflation—the losses were still less severe than in equities alone. This illustrates that diversification isn’t about avoiding losses entirely; it’s about managing their impact.

But not all diversification is equal. Simply owning 20 different mutual funds does not guarantee protection if they all track the same market factors. Real diversification considers drivers of returns: growth vs. value stocks, large vs. small companies, developed vs. emerging markets, and defensive sectors like utilities versus cyclical ones like technology. Factor-based investing—allocating across these dimensions—offers a more robust approach. For instance, value stocks often outperform during economic recoveries, while growth stocks lead in low-rate environments. Balancing both creates a more adaptive portfolio.

However, there’s a point where diversification becomes counterproductive. Overdiversification—owning hundreds of securities across dozens of funds—can dilute returns, increase complexity, and raise costs. It may also lead to “diworsification,” a term coined by Peter Lynch, where adding more investments actually reduces clarity and performance. On the flip side, underdiversification—such as holding only tech stocks or a single real estate market—exposes investors to sector-specific or regional downturns. The goal is intelligent diversification: enough variety to reduce unnecessary risk, but enough focus to capture long-term market growth.

The Cost of Compounding Ignorance: Fees, Taxes, and Time Leaks

Most investors underestimate the corrosive effect of small, recurring costs. A 1% annual fee seems minor—until you see its impact over decades. Consider two portfolios with identical pre-fee returns of 6% annually. One charges 0.10% in expenses, the other 1.0%. After 30 years, the lower-cost portfolio grows to nearly 58% more wealth. On a $100,000 initial investment, that’s the difference between $574,000 and $850,000. These “time leaks” are invisible in the short term but catastrophic in the long run.

Fees come in many forms: expense ratios on mutual funds and ETFs, advisor fees, trading commissions, and bid-ask spreads. Some are transparent, others hidden. Actively managed funds often charge 0.5% to 2% or more, while index funds can cost as little as 0.03%. The difference compounds relentlessly. Morningstar research shows that low-cost funds outperform high-cost funds in every asset class over long periods, even before adjusting for risk. Costs matter more than stock-picking skill for most investors.

Taxes are another major drag. Selling investments in taxable accounts triggers capital gains taxes. Frequent trading can turn modest gains into tax liabilities that erode returns. Worse, selling at a loss locks in taxes paid on earlier gains. Tax-efficient strategies include holding investments longer to qualify for lower long-term rates, using tax-advantaged accounts like IRAs and 401(k)s, and practicing tax-loss harvesting—selling losers to offset gains. Equally important is asset location: placing high-growth or high-dividend assets in tax-deferred accounts, while holding tax-efficient assets like index funds in taxable accounts.

But the biggest cost isn’t financial—it’s behavioral. Panic-selling during downturns, chasing hot sectors, or jumping into trendy investments at peak prices can cost investors 2–3% annually, according to Dalbar’s annual investor behavior studies. These “behavioral fees” are self-inflicted but entirely avoidable. The solution is not better timing—it’s better structure. Automating contributions, using dollar-cost averaging, and setting predefined rules reduce the need for decisions at emotional turning points.

Building Your Financial Flywheel: Discipline Meets Design

Wealth doesn’t grow from sudden windfalls; it accumulates through consistent, repeatable actions. The concept of a financial flywheel captures this idea—a system where small, regular inputs build momentum over time. Just as a physical flywheel resists stopping once spinning, a well-designed financial system gains inertia. Contributions, reinvested dividends, compound growth, and disciplined rebalancing create a self-reinforcing cycle that works even when attention fades.

The foundation of this flywheel is automation. Setting up automatic transfers from checking to investment accounts ensures consistency. Even modest amounts—$200 a month—grow substantially over decades. At a 6% annual return, that’s over $200,000 in 30 years. But more importantly, automation removes emotion from the equation. You’re not deciding whether to invest each month; the system does it for you. This eliminates hesitation, procrastination, and market-timing attempts.

Another key input is regularity. Studies show that investors who contribute steadily—regardless of market conditions—outperform those who time their entries. Dollar-cost averaging, where you invest the same amount regularly, buys more shares when prices are low and fewer when high. Over time, this smooths out volatility and reduces average cost per share. More importantly, it fosters discipline. While sporadic investors wait for the “right moment,” consistent ones are already building equity.

Simplicity strengthens the flywheel. Too many accounts, funds, or strategies create friction and confusion. A clear, streamlined system—such as a three-fund portfolio (total stock market, total international, and bond fund)—reduces decision fatigue and increases adherence. When investing feels complicated, people disengage. When it’s simple, they stay in. The goal isn’t complexity—it’s sustainability. A flywheel that runs on simplicity keeps turning, even during life’s busiest seasons.

Guardrails Over Guesswork: Automating Risk Control

Markets are unpredictable. Anyone who claims to know where the S&P 500 will be in a year is either guessing or misleading. But while prediction is futile, preparation is powerful. The most effective investors don’t rely on forecasts; they rely on rules. These guardrails—predefined thresholds and automatic actions—prevent emotional decisions and maintain long-term discipline. They turn investing from a gamble into a process.

One of the most effective tools is automatic rebalancing. Over time, different assets grow at different rates. A 60/40 portfolio might become 70/30 after a bull market. Rebalancing sells excess gains in the outperforming asset and buys more of the underperforming one—enforcing the principle of “selling high and buying low.” Doing this annually or when allocations drift beyond a set band (e.g., ±5%) removes subjectivity. Studies show that disciplined rebalancing improves risk-adjusted returns over time.

Another guardrail is a drawdown alert—a rule that triggers review if the portfolio falls by a certain percentage. For example, if your account drops 15%, it doesn’t mean you sell, but it does mean you pause and evaluate. Is your asset allocation still aligned? Have your goals changed? This prevents reactive panic while allowing for thoughtful adjustment. Similarly, position limits—such as not allowing any single holding to exceed 10–15% of the portfolio—prevent concentration risk from creeping in unnoticed.

Rules also apply to contributions. Setting a target, such as investing 15% of income annually, and increasing it with each raise, ensures progress without annual renegotiation. These systems don’t guarantee profits, but they dramatically increase the odds of staying on track. They shift the focus from being right to being resilient. And in the long game of wealth building, resilience beats prediction every time.

The Enduring Edge: Patience, Not Prediction

The greatest edge in investing isn’t intelligence, access, or luck—it’s patience. History shows that the most successful investors aren’t those who predict the market, but those who stay in it. Consider this: missing just the 10 best days in the S&P 500 over a 20-year period can cut total returns by nearly half. Those best days often come immediately after the worst ones, during moments of maximum fear. Trying to time the market means risking exactly that—exiting before the rebound and re-entering too late.

Data from J.P. Morgan Asset Management illustrates this clearly. From 2003 to 2022, a $10,000 investment in the S&P 500 grew to about $45,000. But if an investor missed the 10 best days, the final value would be only $25,000. Miss the 20 best days, and it drops to $17,000. This isn’t a call to ignore risk—it’s a reminder that continuity matters. The cost of inaction during fear is often greater than the cost of action during uncertainty.

Patience also brings psychological benefits. A structured, rule-based approach reduces stress. You don’t lie awake wondering if you should sell. You don’t feel guilt for missing a rally. You know your system is designed for the long term. This peace of mind is a form of wealth in itself. Financial confidence isn’t about having the biggest portfolio; it’s about trusting your plan.

Ultimately, financial success isn’t measured by peak returns, but by sustainable outcomes. It’s waking up at 70 and knowing you don’t need to work. It’s helping your children without threatening your own security. It’s living in alignment with your values, not market noise. The path isn’t flashy, but it’s reliable. By focusing on systems—not shortcuts—you build wealth without walls—protected not by luck, but by design. And in that design lies the quiet, enduring power of lasting financial freedom.