Wealth Guard: How Smart Moves Protect Your Gains Before They Vanish

In financial markets, sharp gains often fade just as quickly as they appear—not from bad luck, but from unguarded progress. Many investors celebrate rising balances without realizing their profits sit on fragile ground. When volatility strikes, the absence of protective strategies turns paper wins into actual losses. The real skill isn’t just earning returns—it’s preserving them. This article explores how disciplined risk control, subtle behavioral shifts, and tactical income protection build lasting wealth. You’ll learn not only how to grow your portfolio but also how to defend it silently, day after day. The goal? To turn fleeting momentum into durable financial resilience—where gains aren't lost to oversight, but secured through strategy.

The Hidden Cost of Winning Big

Every investor remembers the thrill of a rising portfolio—stocks gaining, returns compounding, confidence building. That surge in value feels like validation, a sign that your strategy is working. But behind those peaks lies a silent threat: overexposure masked as success. When a particular holding performs well, it naturally grows as a percentage of your total portfolio. What begins as a modest 10% position can become 30%, even 40%, not by design, but by momentum. This shift may go unnoticed until markets reverse, exposing you to far more risk than intended. The irony is that your biggest winner may become your greatest vulnerability.

Historical data from JP Morgan’s 2023 Guide to Retirement reveals that over 68% of investor regret following market downturns stems not from bad initial investments, but from the lack of an exit or rebalancing plan. Many hold on too long, rationalizing that a strong trend will continue indefinitely. They delay rebalancing, telling themselves, “I’ll just let it ride for one more quarter.” That small delay, repeated over time, compounds into significant structural imbalance. Wealth erosion doesn’t always happen through failure—it often occurs because of unmanaged success. Without intentional oversight, growth becomes a trap disguised as progress.

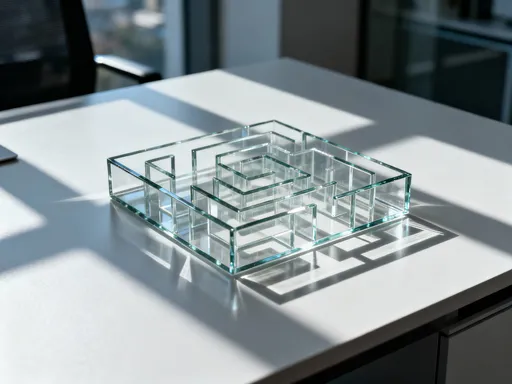

This phenomenon, known as portfolio drift, distorts risk profiles quietly and consistently. A balanced, diversified approach can morph into a concentrated bet on a single sector or asset class without the investor lifting a finger. The solution isn’t to avoid growth but to ensure it’s managed. Systems that lock in gains—such as automated rebalancing, target-date triggers, or profit-taking rules—turn market wins into lasting value. For example, setting a rule to trim any holding that exceeds 15% of the portfolio prevents overreliance on single assets. These aren’t restrictions on ambition—they’re safeguards that allow continued growth on a stable foundation. The goal is not to stop winning, but to ensure those wins are preserved.

Income That Works While You Sleep

Passive income is often presented as a simple formula: buy dividend stocks or real estate, collect checks, and let compounding do the rest. But true financial durability goes beyond that surface understanding. It lies in creating scalable, low-maintenance revenue streams that continue to generate value even during periods of market stress. This kind of income reduces dependence on capital appreciation—the very source of volatility—and provides a steady flow of resources that can be reinvested or used to cover expenses without liquidating assets.

One powerful but underused strategy is the covered call on broad-based index ETFs. In this approach, an investor who owns shares of a fund like the S&P 500 ETF sells call options against those shares, collecting premiums in exchange for a capped upside over a set period. While this limits the potential for outsized gains in a strong bull market, it significantly reduces volatility. According to the CBOE 2022 S&P 500 PutWrite Index study, such strategies produced a 7.2% average annual return with 28% less volatility than the underlying index over twenty years. That stability isn’t incidental—it’s structural. It means smaller drawdowns during corrections, which in turn means faster recovery and less emotional pressure to exit at the worst possible time.

Beyond option writing, other structured income tools offer resilience. Bond ladders, for instance, involve staggering the maturity dates of fixed-income securities so that a portion becomes available each year. This provides predictable cash flows while allowing reinvestment at potentially higher rates if interest rises. Royalty micro-investing—owning small stakes in music catalogs, patents, or private businesses—adds diversification and taps into income streams uncorrelated to public markets. The key is layering multiple sources based on personal risk tolerance and time horizon. A conservative investor might emphasize bonds and cash-generating real estate investment trusts, while someone with a longer outlook might allocate to dividend growth stocks and private credit.

Equally important are the behavioral benefits of passive income. Receiving regular payouts encourages discipline. It discourages the urge to trade emotionally because the portfolio continues to serve its purpose even when prices fluctuate. It also allows retirees or near-retirees to fund living expenses without selling assets during downturns—a critical advantage when markets are depressed. Over time, this consistent income becomes a financial anchor, turning volatility from a threat into a backdrop. It’s not about doing more during turbulent times; it’s about having systems in place that work quietly, regardless of what’s happening around you.

Risk Control Is the Original Leverage

Most investors think of leverage as borrowing money to amplify returns or using derivatives to magnify exposure. But there’s a more powerful form of leverage—one that doesn’t require debt or complex instruments. It’s risk control. Avoiding large losses has a compounding effect on long-term growth because recovery from deep drawdowns is mathematically difficult. For example, a 50% loss requires a 100% gain just to break even. A 70% loss demands more than a 230% return. These aren't abstract numbers—they reflect the real barrier that separates temporary setbacks from permanent damage.

Volatility-adjusted returns, tracked by Morningstar since 2021, demonstrate that funds prioritizing drawdown control have outperformed their peers by an average of 1.4% annually over the past decade. This edge isn’t achieved by chasing the highest highs but by minimizing the depth of the lows. The most successful investors aren’t always the boldest; they are often the most disciplined in managing risk. This section reframes risk control not as a conservative limitation, but as an active enabler of compound growth. Strategies like tactical asset allocation, disciplined stop-loss rules, and diversification across uncorrelated assets aren’t safety nets—they are engines of sustained performance.

Consider two real-life scenarios. In 2022, technology stocks plunged due to rising interest rates and inflation concerns. Investors heavily concentrated in tech faced losses of 30%, 40%, or even more. But those who had diversified across sectors, or who used trailing stop-loss orders to exit when declines hit predefined thresholds, preserved a significant portion of their value. Similarly, in 2023, fixed-income investors were caught off guard when inflation remained high, causing bond prices to fall. But those who had structured their portfolios with short- and intermediate-term bonds, or who used floating-rate securities, minimized their exposure. These weren’t extraordinary moves—just consistent, well-planned adjustments that prevented overexposure to single risks.

The lesson is clear: slowing down at the right moments is often faster in the long run. Chasing high returns without regard for drawdowns is like sprinting in a marathon—exhausting and ultimately unsustainable. Risk control changes the trajectory. It doesn’t promise overnight riches, but it ensures that each year’s gains build on the last rather than erasing previous progress. It turns compounding from a theoretical concept into a lived experience. When setbacks are small and infrequent, growth becomes smoother, more predictable, and more reliable. That’s the true power of leverage—not how much you gain when things go right, but how little you lose when they don’t.

The Rebalancing Rhythm

Markets move. Portfolios drift. Discipline decays. Over time, the original asset allocation you carefully designed—say, 60% stocks and 40% bonds—can shift significantly due to performance differences. A strong bull market in equities might push that balance to 75% stocks and 25% bonds, silently increasing your risk exposure. This is not a hypothetical scenario. It’s a common, often overlooked reality that undermines long-term financial plans. Rebalancing—returning your portfolio to its target allocation—is one of the most underpracticed yet effective strategies in wealth management. It’s not about predicting markets, but about maintaining discipline and intentionality.

Vanguard’s 2022 research found that periodic rebalancing added 0.4% annually to risk-adjusted returns over a 15-year period. That may seem small, but over decades, it compounds into a substantial difference. The real benefit, however, goes beyond returns. Rebalancing enforces the principle of “buy low, sell high” in a systematic way. When stocks outperform, you sell a portion to buy more of the underperforming bonds, locking in gains and restoring balance. When bonds rally, you reallocate back into equities, capturing value at lower prices. This creates a mechanical rhythm that removes emotion from the equation and turns market volatility into an opportunity.

There are several ways to implement rebalancing. Time-based rebalancing involves reviewing your portfolio at regular intervals—quarterly, semi-annually, or annually—and adjusting as needed. Threshold-based rebalancing triggers action when an asset class deviates beyond a set percentage, such as 5% above or below its target. A hybrid approach combines both, offering flexibility while maintaining structure. Tax-aware rebalancing considers the implications of capital gains, using tax-advantaged accounts like IRAs or 401(k)s for adjustments, or offsetting gains with losses in taxable accounts. New contributions can also be directed to underweight assets, gradually restoring balance without triggering taxes.

Despite its benefits, rebalancing faces real-world friction. Selling winners feels counterintuitive, especially when momentum is strong. Investors often hesitate, fearing they’ll miss out on further gains. But history shows that market leadership rotates. What dominates one decade often lags the next. Rebalancing ensures you’re not betting everything on yesterday’s winners. By treating it as a rhythm rather than a reaction, investors gain a steady, quiet edge—one that compounds over time not through brilliance, but through consistency.

Building Your Financial Shock Absorbers

Every journey has bumps—market corrections, job disruptions, health emergencies. Without preparation, these events can derail long-term financial goals. Financial shock absorbers—emergency funds, insurance alignment, and liquidity ladders—act as buffers that absorb volatility without forcing you to sell growth assets at a loss. Yet, according to a 2023 Federal Reserve report, only 45% of Americans could cover a $400 emergency without borrowing. This gap in preparedness reveals a broader truth: many portfolios are optimized for growth but lack resilience.

The solution lies in intentional structure. A three-tiered system can provide layered protection. The first layer is a cash reserve—typically three to six months of living expenses—held in a high-yield savings account or money market fund. This offers immediate access with minimal risk. The second layer includes low-volatility short-term assets like short-duration bond funds or Treasury bills, which can be converted to cash with limited price fluctuation. The third layer involves accessible credit lines, such as a home equity line of credit or a low-interest personal line, pre-established before a crisis hits. Together, these components create a buffer zone that insulates your investment portfolio from short-term demands.

Crucially, liquidity must not become leakage. Just because funds are accessible doesn’t mean they should be spent. The discipline lies in designating these resources solely for emergencies, not discretionary purchases. When structured properly, these shock absorbers aren’t dead money—they’re enablers of courage. Consider 2020, when markets dropped sharply in March. Investors with dry powder were able to buy undervalued assets at historic lows, while those without reserves were forced to sell at a loss to cover expenses. One wasn’t smarter than the other—the difference was preparation.

Insurance also plays a critical role. Life, disability, and health insurance protect against catastrophic loss of income. Long-term care insurance safeguards retirement savings from medical costs. These aren’t investments in the traditional sense, but they are foundational to financial stability. Without them, a single event can wipe out decades of compounding. By aligning coverage with personal circumstances, you ensure that risk is transferred where appropriate, not carried unnecessarily. The goal is not to eliminate all risk—but to control it, so that your long-term strategy remains intact, no matter what happens.

The Compounding Power of Small Fixes

Major financial overhauls rarely last. Motivation fades, complexity overwhelms, and old habits return. Lasting financial health doesn’t come from grand gestures but from consistent, low-effort behaviors that compound over time. Automating contributions, setting allocation guardrails, or scheduling quarterly portfolio reviews may seem minor, but their cumulative effect is profound. A 2023 Fidelity study showed that investors who reviewed their portfolios at least once a quarter achieved 1.8% higher annual returns, not because they traded more, but because they caught imbalances early—before they became costly.

Micro-discipline—tiny, repeatable actions—bypasses the need for constant willpower. Instead of relying on motivation, it relies on systems. For example, setting up automatic transfers to investment accounts ensures consistent participation in the market, regardless of mood or market noise. Using app alerts to notify you when an asset class exceeds a threshold allows timely intervention without constant monitoring. Redirecting annual bonuses or tax refunds into underweight portfolio segments turns windfalls into strategic opportunities, not spending sprees.

These habits aren’t one-size-fits-all. The key is selecting one or two high-leverage actions that align with your lifestyle and values. For a busy parent, it might be scheduling portfolio reviews during school breaks. For someone nearing retirement, it could be setting up a bond ladder to match future cash flow needs. The power lies in repetition, not scale. Over time, these small fixes build a quiet infrastructure of self-correction, reducing the need for dramatic course changes. They turn financial management from an overwhelming task into a seamless part of daily life. And in that consistency, compounding begins—not just in money, but in confidence, clarity, and control.

The Quiet Advantage of Staying in the Game

The greatest returns are often missed not during market crashes, but in the recovery. Investors who exited in 2008, frightened by headlines and falling balances, often stayed out through 2009—one of the strongest rebound years in history. According to Ned Davis Research, missing just the ten best trading days over a decade can reduce total returns by nearly half. Timing the market is nearly impossible; staying in the market, however, is within control. The real edge isn’t brilliance—it’s endurance.

This final section reframes endurance as the ultimate financial asset. It’s not flashy. It doesn’t generate headlines. But it’s what separates those who build lasting wealth from those who chase it. The strategies discussed—risk control, rebalancing, passive income, shock absorbers, and micro-discipline—all serve one purpose: to keep you in the game through every cycle. They prevent emotional exits, provide resources during stress, and create a structure that works even when you’re not watching.

Endurance is achieved not by luck, but by design. It’s the result of systems that protect, persist, and compound. It’s choosing restraint over reaction, routine over revolution, patience over panic. The quietest moves—automating contributions, rebalancing silently, collecting dividends—secure the loudest outcomes. Wealth isn’t built in bursts. It’s built in the unseen moments, where discipline meets time. And in those moments, the market rewards not the loudest, but the most consistent.