Wealth Without the Wrecking Ball

In a world where financial headlines scream volatility and get-rich-quick schemes lure the impatient, true wealth builders stay quiet—focused not on windfalls, but on consistency, clarity, and control. Many chase returns only to be wiped out by unseen risks. Others save diligently but watch inflation erode their progress. The difference between success and setback isn’t luck—it’s strategy. Behind every lasting fortune is a framework that balances growth with protection, action with restraint. This is not about extreme frugality or aggressive trading. It’s about mastering the middle ground: earning steadily, guarding fiercely, and acting with purpose. For those who want results without recklessness, the path forward begins with one question: How do you grow wealth without risking everything?

The Hidden Cost of Chasing Returns

Many investors fall into the trap of prioritizing returns above all else, believing that higher numbers automatically mean better outcomes. This mindset, however, overlooks a critical truth: return is only meaningful when weighed against risk. A portfolio that gains 15% in a year might seem impressive, but if it drops 40% the next, the long-term damage can be severe. The math of loss is unforgiving—losing half your money requires a 100% gain just to break even. When investors focus solely on upside potential, they often expose themselves to assets that are volatile, illiquid, or poorly understood, setting the stage for emotional decisions under pressure.

Consider the example of someone who, in the midst of a market rally, shifts a large portion of savings into a single high-flying tech stock. The initial gains spark excitement, reinforcing the belief that bold moves pay off. But when the market corrects—or the company faces regulatory or operational setbacks—the same investor may panic and sell at a loss. This pattern, repeated across millions of portfolios, illustrates how chasing returns can actually undermine wealth. Emotional highs fuel entrance, and fear drives the exit, turning what seemed like a smart gamble into a costly lesson. The problem isn’t the asset itself, but the lack of context, preparation, and alignment with long-term goals.

A more sustainable path begins with redefining success. Instead of asking “What’s returning the most right now?”, the better question is “What can I afford to lose, and what do I need to achieve?” Historical data shows that balanced portfolios—mixing equities, bonds, and real assets—have delivered strong long-term results with far less volatility than aggressive strategies. For instance, a 60/40 stock-bond portfolio has historically returned around 7-8% annually over decades, with significantly smoother growth curves than all-stock or speculative approaches. The key advantage lies not in outperforming every year, but in avoiding catastrophic losses that take years to recover from.

Moreover, chasing returns often leads to frequent trading, which introduces additional costs—commissions, taxes, and bid-ask spreads—that quietly eat into profits. A study by Dalbar Inc. found that the average investor underperforms market indices by roughly 4% annually, largely due to poor timing and emotional decisions. This “behavior gap” is not caused by lack of intelligence, but by the absence of a disciplined framework. By contrast, investors who focus on consistent contributions, asset allocation, and long-term compounding tend to achieve better outcomes, not because they pick the best stocks, but because they avoid the worst mistakes.

Risk: Not the Enemy, but the Compass

Risk is often misunderstood as something to avoid at all costs, but in reality, it is an essential guidepost in financial planning. Just as a sailor uses wind direction to chart a course, smart investors use risk to shape their decisions. The goal is not to eliminate risk—this is impossible—but to understand it, measure it, and manage it wisely. There are several types of risk that quietly influence financial outcomes: market risk, inflation risk, longevity risk, and behavioral risk. Each operates differently, but all can derail a plan if ignored.

Market risk refers to the possibility of losing value due to economic or geopolitical events. While this is the most visible form of risk, it is also the most manageable through diversification. Inflation risk is less dramatic but more insidious—the gradual loss of purchasing power over time. A dollar saved today may be worth only forty cents in 20 years if inflation averages 3% annually. Longevity risk is the danger of outliving your savings, a growing concern as life expectancy increases. Behavioral risk, perhaps the most personal, stems from emotional reactions—selling in fear during downturns or buying in greed during booms.

Understanding these risks allows investors to build portfolios that are not just designed for growth, but for resilience. For example, someone in their 30s might tolerate more market risk because they have time to recover from downturns, but they cannot ignore inflation risk, which will erode the value of cash holdings over decades. A retiree, on the other hand, may prioritize capital preservation and income stability, making longevity and market risk the central concerns. The insight is that risk tolerance is not a fixed trait, but a dynamic factor shaped by age, goals, income, and personal psychology.

Ignoring risk doesn’t make it disappear—it only delays the consequences. A common mistake is to assume that “safe” assets like cash or savings accounts carry no risk. In truth, they expose the holder to high inflation risk, especially in periods of rising prices. Similarly, avoiding stocks entirely may feel cautious, but it can limit long-term growth potential, making it harder to fund retirement or large goals. The disciplined investor doesn’t fear risk but respects it, using it to inform decisions about asset allocation, contribution rates, and withdrawal strategies. By treating risk as a compass, not a threat, they stay aligned with their true destination.

Building Your Financial Foundation: Assets That Work for You

The foundation of lasting wealth is not a single lucky investment, but a collection of productive assets that generate returns over time. These are not speculative bets, but engines of compounding—reliable, income-producing holdings that grow quietly in the background. The most effective of these include dividend-paying stocks, real estate, broad-market index funds, and high-quality bonds. Each serves a role: equities offer growth, real estate provides income and inflation protection, and bonds add stability. Together, they form a diversified base that can withstand market cycles and deliver consistent results.

Dividend-paying stocks, for instance, offer a dual benefit: potential price appreciation and regular income. Companies with a history of increasing dividends—often called “dividend growers”—tend to be financially strong and shareholder-friendly. When dividends are reinvested, they accelerate wealth through compounding. A study of the S&P 500 from 1930 to 2020 found that reinvested dividends contributed nearly 40% of total returns. This means that an investor who only focused on price gains missed the majority of the opportunity. The beauty of dividends is that they can be collected regardless of market direction, providing a steady stream of value even during downturns.

Real estate is another foundational asset, offering both rental income and long-term appreciation. Unlike stocks, it is a physical asset that tends to hold value during inflationary periods. While owning property requires more effort than buying a fund, the rise of real estate investment trusts (REITs) has made this asset class accessible to everyday investors. REITs trade like stocks but invest in income-generating properties—apartments, offices, warehouses—and are required by law to distribute at least 90% of taxable income to shareholders. This structure creates a reliable income stream, with historical average returns comparable to equities over the long term.

Index funds represent perhaps the most powerful tool for building wealth without complexity. By tracking broad markets like the S&P 500 or total U.S. stock market, they offer instant diversification at low cost. Vanguard’s first index fund, launched in 1976, was initially mocked as “Bogle’s folly” but has since become one of the most successful investment products in history. The secret is not brilliance, but consistency: by holding thousands of companies and minimizing fees, index funds capture market returns without relying on individual stock picks. For a working parent with limited time, this is a major advantage—no need to follow earnings reports or time the market.

High-quality bonds—such as U.S. Treasuries or investment-grade corporate bonds—complete the foundation by providing stability and income. While they typically return less than stocks, they are less volatile and can act as a buffer during market declines. In a balanced portfolio, bonds help smooth returns and reduce overall risk. Crucially, these assets are not reserved for the wealthy. With as little as $100, one can begin building exposure through low-cost ETFs or mutual funds. The key is not the amount invested today, but the habit of investing consistently over time.

The Discipline of Defensive Investing

Growth gets the headlines, but protection ensures survival. Defensive investing is not about avoiding risk entirely, but about building resilience into every financial decision. This includes strategies like diversification, maintaining emergency reserves, controlling costs, and managing debt. These elements may not seem exciting, but they are what separate long-term success from short-lived gains. History shows that many high earners end up financially insecure not because they didn’t make money, but because they failed to protect it.

Take the case of two professionals, both earning $120,000 annually. One spends freely, carries credit card debt, and invests in a few trendy stocks. The other tracks expenses, pays off balances monthly, maintains a six-month emergency fund, and invests in a diversified portfolio. On paper, their incomes are identical, but their financial trajectories are worlds apart. When job loss or medical bills strike, the first may be forced to sell investments at a loss or take on high-interest debt. The second can weather the storm without derailing long-term plans. The difference is not income, but financial headroom—the margin between income and spending that creates breathing space during crises.

Diversification is another pillar of defense. Holding a mix of assets across different sectors, geographies, and types reduces the impact of any single failure. During the 2008 financial crisis, for example, portfolios concentrated in real estate or financial stocks suffered devastating losses. Those with exposure to bonds, international markets, or defensive sectors like healthcare fared much better. The principle is simple: don’t rely on one source of returns. Even within asset classes, diversification matters—owning a single stock is riskier than holding an index fund, regardless of how promising the company seems.

Cost control is equally important. High fees—whether from mutual funds, advisors, or trading—erode returns over time. A 1% annual fee may seem small, but over 30 years, it can consume 25% or more of potential gains. Low-cost index funds, automated platforms, and do-it-yourself investing have made it easier than ever to reduce expenses. Additionally, minimizing lifestyle inflation—the tendency to spend more as income rises—preserves capital for investment. The goal is not deprivation, but intentionality: spending on what matters while safeguarding resources for the future.

Smarter Systems Over Willpower

Willpower is overrated. Motivation fades, discipline wavers, and emotions interfere. The most successful investors don’t rely on daily willpower—they build systems that work automatically. These include payroll deductions into retirement accounts, automatic transfers to investment platforms, and rules-based strategies like dollar-cost averaging. When investing becomes routine, it becomes reliable. Data shows that investors who automate contributions accumulate significantly more wealth than those who try to time or manage investments manually.

Dollar-cost averaging—investing a fixed amount at regular intervals—removes the need to predict market movements. Whether prices are high or low, the investor continues to buy. Over time, this leads to a lower average cost per share. While not always superior to lump-sum investing in theory, it is often better in practice because it reduces the risk of investing a large sum just before a downturn. More importantly, it builds consistency. A study by Fidelity found that the best-performing accounts were often those where the owner forgot they existed—proof that doing less can lead to better results.

Behavioral guardrails also play a crucial role. Rules like “never withdraw principal” or “reinvest all dividends” create structure without requiring constant decision-making. These are not restrictions, but enablers—designed to prevent rash choices during stress. For example, someone who automatically reinvests dividends will continue to compound gains even if they feel tempted to spend the cash. Similarly, setting a rule to avoid selling during market drops prevents panic-driven losses. These systems turn good intentions into lasting habits.

Seeing Beyond the Noise: Financial Clarity in Chaos

The modern investor faces a barrage of information—news alerts, social media tips, algorithm-driven recommendations. Much of it is noise, not insight. The challenge is not in accessing data, but in filtering it. Financial clarity comes not from more information, but from better criteria. The most useful filters are time horizon, personal goals, and cost efficiency. A young parent saving for college has different needs than a retiree drawing down assets. A short-term trader focuses on volatility; a long-term builder focuses on compounding.

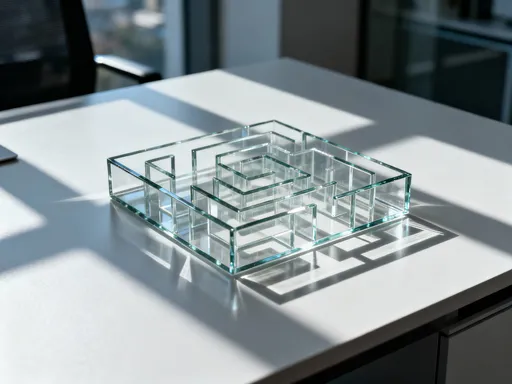

Think of it as using a compass instead of a radar screen. The compass points to true north—your destination—while the radar shows every blip and movement around you. Watching the radar may make you feel informed, but it can also make you reactive. A portfolio that changes daily in response to headlines is likely to underperform one that is reviewed quarterly and adjusted only when necessary. Simplicity is a strength: many successful investors hold only a few well-chosen funds and make changes infrequently.

Periodic review—once or twice a year—is far more effective than constant monitoring. This allows time for trends to emerge and emotions to settle. During these reviews, investors can assess progress, rebalance if needed, and ensure alignment with goals. Tools like target-date funds or robo-advisors can automate this process, offering professional-level management without the complexity. The goal is not to be indifferent to markets, but to be intentional about engagement.

The Enduring Advantage: Patience with Purpose

True wealth is not measured by the size of a portfolio, but by the freedom it provides. It is not a sudden windfall, but a quiet accumulation of smart, repeatable choices. The most powerful forces in finance—compounding, consistency, and emotional control—work slowly, but they never stop. A $300 monthly investment earning 7% annually grows to over $500,000 in 40 years. The math is simple, but the discipline required is profound.

Patience with purpose means understanding that wealth is a long game. It means resisting the lure of shortcuts and embracing the steady path. It means knowing that peace of mind is worth more than a speculative gain. The investor who avoids panic, controls costs, reinvests dividends, and stays diversified may never make headlines, but they will likely achieve financial security. Their victory is not flashy, but it is lasting.

In the end, wealth is not about having more than others—it is about having enough to live with dignity, choice, and peace. It is about knowing that you are prepared, not perfect. By building a foundation of productive assets, managing risk wisely, and automating good habits, anyone can grow wealth without risking everything. The quiet path is not the easiest, but it is the most reliable. And for those who walk it, the rewards are not just financial—they are deeply human.