Wealth Without the Waves: How to Earn, Protect, and Keep Your Gains

In a world where financial noise never sleeps—markets swing, trends flip, and advice pours from every screen—many people chase returns only to find themselves exposed, exhausted, or worse, losing ground. True financial progress isn’t about catching every opportunity; it’s about building a strategy that earns consistently, withstands shocks, and keeps you in control. This isn’t speculation. It’s structure. By focusing on how to generate income wisely, protect capital purposefully, and apply practical habits daily, anyone can shift from reacting to planning. The goal? Lasting growth without constant stress. Financial confidence isn’t reserved for the wealthy or the mathematically gifted—it’s available to anyone willing to adopt a disciplined, clear-eyed approach. This article outlines how to build that foundation, step by step, with real tools and lasting principles.

The Income Engine: What Actually Fuels Sustainable Earnings

At the heart of every stable financial life is a reliable income engine. This doesn’t mean chasing the highest-paying job or the flashiest side hustle. It means understanding the three pillars of sustainable earnings: earned income, investment returns, and passive cash flow. Earned income—what you receive from work—remains the starting point for most people. But relying solely on a paycheck limits long-term growth. The real shift happens when you begin to build streams that work even when you’re not actively laboring. Investment returns, such as dividends from stocks or interest from bonds, allow your money to generate more money. Passive cash flow, like rental income or royalties, takes this a step further by delivering earnings with minimal ongoing effort. These sources don’t replace hard work; they amplify it.

Many people fall into the trap of equating high returns with high rewards, only to realize too late that volatility isn’t profit. Consider two investors: one who swings between 50% gains and 30% losses in consecutive years, and another who earns a steady 8% annually. Over a decade, the steady earner ends up significantly ahead, despite never having a standout year. This is because consistency compounds more effectively than chaos. Aggressive trading, while exciting, often leads to emotional decisions and higher fees, both of which erode net gains. In contrast, a structured approach—such as reinvesting dividends or contributing regularly to a retirement account—builds wealth gradually but predictably. The key is not timing the market but time in the market.

Building your own income engine starts with a clear audit of your current sources. List every stream: salary, freelance work, side gigs, investment payouts, and any other inflows. Then, assess each for reliability, growth potential, and scalability. Can your freelance work be systematized? Could a portion of your savings be redirected into dividend-paying assets? Are there underutilized skills that could generate passive income? The goal isn’t to overhaul everything at once but to identify one or two leverage points where small improvements can yield long-term results. For example, dedicating just 10% of your income to a diversified investment portfolio can set the stage for decades of compounding. The most powerful engines aren’t built overnight—they’re assembled with intention, one thoughtful decision at a time.

Risk Realities: Why Protection Matters More Than Promotion

Financial growth is only meaningful if it lasts. Too often, people focus on maximizing returns while ignoring the silent killer of wealth: unmanaged risk. Risk isn’t just the possibility of losing money; it’s the exposure to events that can derail your plans—job loss, medical emergencies, market crashes, or even poorly timed financial decisions. The difference between those who build lasting wealth and those who lose it often comes down to how they handle risk, not how aggressively they pursue gain. Protection isn’t a sign of fear; it’s a sign of wisdom. A well-protected financial life doesn’t avoid risk entirely—it manages it strategically, ensuring that setbacks don’t become catastrophes.

One of the most effective tools for risk management is diversification. This means spreading your investments across different asset classes—stocks, bonds, real estate, and cash—so that a downturn in one area doesn’t wipe out your entire portfolio. For example, during the 2008 financial crisis, stock markets dropped sharply, but government bonds actually gained value. Investors who held both saw smaller overall losses. Similarly, asset allocation—the percentage of your portfolio assigned to each type of investment—should reflect your timeline and tolerance for volatility. A 35-year-old saving for retirement might allocate 70% to stocks, while a 60-year-old nearing retirement might shift to 50% or less, favoring stability over growth.

Another critical layer of protection is the emergency fund. Financial experts consistently recommend saving three to six months’ worth of living expenses in a liquid, accessible account. This buffer prevents you from selling investments at a loss during a market dip or resorting to high-interest debt in a crisis. Yet, surveys show that nearly 40% of adults wouldn’t be able to cover a $400 emergency without borrowing or selling something. This gap highlights a dangerous vulnerability. Building an emergency fund doesn’t require a windfall; it starts with small, automatic transfers each month. Over time, this habit creates a financial cushion that allows you to make decisions from strength, not desperation.

Common blind spots also undermine protection. Overconcentration—having too much invested in a single stock, sector, or even employer—is a frequent mistake. Some people pour their savings into their company’s stock, only to face double jeopardy if the business struggles: they lose both their job and their savings. Emotional decision-making is another risk. Panic-selling during a market drop locks in losses, while greed-driven buying at market peaks leads to overpaying. Hidden fees, often buried in mutual fund expense ratios or advisory contracts, quietly drain returns over time. A 1% annual fee may seem small, but over 30 years, it can consume nearly 25% of your potential gains. Awareness is the first step toward control. By regularly reviewing your portfolio, understanding your fees, and aligning your investments with your goals, you turn protection from an afterthought into a core strategy.

The Compound Effect: Small Moves, Big Momentum

If there’s one force that separates long-term wealth builders from everyone else, it’s compounding. Often called the eighth wonder of the world, compounding is the process by which earnings generate their own earnings over time. It’s not a complex formula or a secret strategy—it’s a natural financial law, like gravity. The earlier you start, the more powerful it becomes. Imagine two sisters: one begins investing $200 a month at age 25, earning an average of 7% annually. The other waits until 35 to start, investing the same amount. By age 65, the first sister has nearly twice as much, despite contributing the same monthly amount. The difference? Ten extra years of compounding. Time, not timing, is the true advantage.

Compounding works in more than just investments. It applies to savings, debt reduction, and even financial knowledge. When you save $100 and earn 2% interest, you don’t just get $2—you get $2 on the first year, then $2.04 the next, and so on. That extra four cents earns its own interest, and the cycle continues. Over decades, this snowball effect transforms modest habits into substantial outcomes. The same principle works in reverse with debt. A credit card balance with 18% interest compounds against you, making it harder to pay off the longer it lingers. But when you direct that same energy toward savings and investing, compounding works for you, not against you.

The beauty of compounding is that it doesn’t require large sums to start. A $50 monthly contribution to a retirement account, reinvested with dividends and growth, can grow into tens of thousands over time. The key is consistency. Irregular deposits or frequent withdrawals disrupt the momentum. Think of compounding like a flywheel: the initial push takes effort, but once it’s moving, it gains inertia. Automating contributions—setting up direct deposits into savings or investment accounts—removes the need for willpower and ensures steady progress. Even during market downturns, staying the course allows you to buy more shares at lower prices, enhancing long-term returns through dollar-cost averaging.

Many people underestimate compounding because its effects aren’t visible in the short term. You won’t see dramatic changes in the first year or even the fifth. But by year twenty, the results are undeniable. This is why patience is a financial superpower. It’s not about waiting passively; it’s about trusting the process and avoiding the temptation to interfere. Whether it’s reinvesting dividends, skipping unnecessary purchases, or simply leaving your investments untouched, the small choices you make today lay the foundation for exponential growth tomorrow. Compounding doesn’t reward the smartest or the luckiest—it rewards the consistent.

Budgeting That Works: Align Spending With Values, Not Guilt

Budgeting has a reputation for being restrictive, even punitive. For many, it conjures images of spreadsheets, denial, and constant tracking. But when done right, budgeting isn’t about limitation—it’s about liberation. It’s the tool that allows you to spend intentionally, aligning your money with what truly matters to you. A values-based budget doesn’t ask you to cut out all enjoyment; it asks you to decide where your enjoyment should come from. Should it be daily takeout, or an annual family vacation? A new gadget every year, or a fully funded education fund for your children? The goal isn’t to feel guilty about spending, but to feel confident that your spending reflects your priorities.

Consider two households with the same income: $75,000 per year. One family budgets rigidly but feels deprived, constantly arguing about money. The other creates a flexible plan that includes categories for groceries, utilities, savings, and discretionary spending—plus a line item for “family fun.” They know exactly how much they can spend on dining out, hobbies, and gifts without jeopardizing their goals. As a result, they experience less stress and more satisfaction. The difference isn’t in their income; it’s in their approach. The second family treats budgeting as a decision-making framework, not a punishment. They pay themselves first—automatically routing a portion of each paycheck into savings and investments—then live on what’s left. This simple shift ensures that saving isn’t an afterthought; it’s a priority.

Practical methods make budgeting sustainable. The envelope system, whether physical or digital, allocates set amounts to different spending categories each month. Once the money in a category is gone, spending stops—no guilt, no overspending. Automated transfers do the same for savings and bills, removing the need for constant attention. Some people use the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Others prefer zero-based budgeting, where every dollar is assigned a purpose. The best method is the one you’ll stick with. The goal isn’t perfection; it’s progress. Even a rough budget is better than no budget at all, because it brings awareness. When you know where your money goes, you gain control.

Budgeting also reduces financial friction in relationships. Money is a leading cause of stress in households, but a shared financial plan can turn conflict into collaboration. When both partners understand the goals—whether it’s buying a home, retiring early, or funding a child’s education—they’re more likely to support the decisions needed to get there. Regular check-ins, perhaps once a month, allow for adjustments and celebrations. Did you stick to your grocery budget? That’s a win. Did you save an extra $50 this month? Acknowledge it. These small victories build momentum and reinforce positive habits. Budgeting, at its core, is about making your money work for you—not the other way around.

Debt Decoded: When It’s a Tool and When It’s a Trap

Debt carries a lot of emotional weight. For some, it’s a source of shame; for others, a normal part of life. The truth is, debt isn’t inherently good or bad—it’s a tool, and like any tool, its value depends on how you use it. The key is distinguishing between good debt and bad debt. Good debt is typically low-interest, used to acquire assets that appreciate or generate income. A mortgage on a home, for example, allows you to build equity over time. A student loan can lead to higher earning potential. Business loans can fund growth. These types of debt, when managed responsibly, can accelerate financial progress.

Bad debt, on the other hand, is high-interest and used for consumption rather than investment. Credit card balances, payday loans, and auto loans for depreciating vehicles fall into this category. These debts drain wealth instead of building it. A $5,000 credit card balance at 18% interest can take years to pay off if you only make minimum payments, and you’ll end up paying thousands in interest. The psychological trap is that minimum payments make the debt feel manageable in the short term, but they extend the repayment period and increase total cost. This is why understanding amortization—the way payments are split between principal and interest—is so important. In the early years of a loan, most of your payment goes to interest, not the balance.

Managing debt starts with awareness. Create a full inventory of all your liabilities: credit cards, loans, medical bills, and any other debts. List the balance, interest rate, and minimum payment for each. Then, prioritize them. The debt avalanche method—paying off the highest-interest debt first—saves the most money over time. The debt snowball method—paying off the smallest balance first—builds momentum and motivation. Both work; the best choice depends on your personality. Some people need quick wins to stay committed; others want maximum efficiency.

Avoiding new bad debt is equally important. That means using credit cards responsibly—ideally, paying the balance in full each month. If you can’t pay it off, it’s probably not a necessary purchase. Consider switching to cash or debit for discretionary spending to stay within your means. At the same time, don’t fear all debt. A low-interest mortgage or a student loan with a clear return on investment can be powerful allies in building wealth. The goal isn’t to eliminate all debt at all costs; it’s to use it strategically, with a clear plan for repayment. When debt serves your goals instead of controlling them, it becomes a tool for progress, not a burden.

Investing Without Guessing: A Clear Path Through the Noise

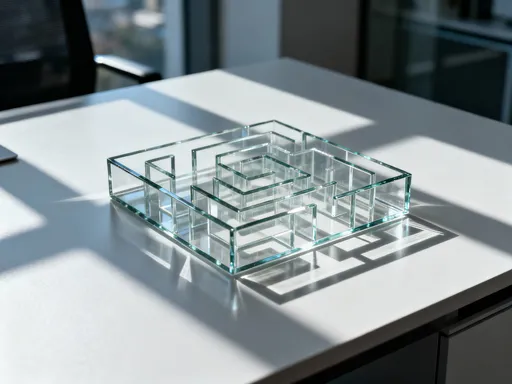

Investing often feels like navigating a maze blindfolded. With endless products, conflicting advice, and daily market swings, it’s easy to feel overwhelmed or tempted to guess. But successful investing isn’t about predicting the future; it’s about following a clear, disciplined process. The foundation of this process is simple: low-cost index funds, dollar-cost averaging, and asset allocation. Index funds track broad market segments, like the S&P 500, and offer instant diversification. Because they’re passively managed, they have lower fees than actively managed funds, which means more of your money stays invested. Historically, most actively managed funds fail to beat their benchmarks over time, making low-cost index funds a reliable choice for long-term growth.

Dollar-cost averaging—investing a fixed amount at regular intervals—removes the pressure to time the market. Whether the market is up or down, you buy shares at the current price. Over time, this averages out your cost and reduces the risk of buying at a peak. For example, investing $200 every month means you buy fewer shares when prices are high and more when they’re low. This strategy works best when combined with a long-term mindset. Market swings are normal; they’re not emergencies. A 10% drop isn’t a reason to sell—it’s an opportunity to buy more at a discount. Those who panic during downturns often miss the recovery, locking in losses.

Asset allocation—dividing your portfolio among stocks, bonds, and cash based on your goals and risk tolerance—is the final piece. A young investor with decades until retirement can afford more stock exposure, while someone nearing retirement may prefer more bonds for stability. Rebalancing once a year ensures your portfolio stays aligned with your target. If stocks have grown to 80% of your portfolio but your goal is 70%, you sell some stocks and buy bonds to restore balance. This forces you to sell high and buy low, a counterintuitive but effective strategy.

The emotional challenge of investing is real. It’s tempting to chase hot stocks or pull out during a crisis. But discipline beats instinct. Those who stay the course, ignoring the noise and sticking to their plan, consistently outperform those who try to outsmart the market. Investing isn’t a game of winners and losers; it’s a marathon of consistency. By focusing on what you can control—your savings rate, your fees, your behavior—you build wealth not through luck, but through logic.

The Financial Flywheel: How Habits Turn Into Wealth

Wealth isn’t created in a single moment. It’s the result of small, repeated actions that build momentum over time. This is the concept of the financial flywheel: an initial effort that, once set in motion, gains inertia and becomes self-sustaining. The first push is the hardest—starting to save, creating a budget, opening an investment account. But each time you follow through, the wheel turns a little easier. Reviewing your statements monthly, adjusting your goals annually, learning from mistakes—these habits compound just like money. The more you do them, the more natural they become, and the greater the results.

Consider the power of routine financial check-ins. Setting aside one hour each month to review your accounts, track progress, and adjust spending can prevent small issues from becoming big problems. Did an unexpected bill throw off your budget? Adjust next month’s plan. Did your investment portfolio drift from your target allocation? Rebalance it. These small acts of maintenance keep your financial engine running smoothly. They also build confidence. When you know where you stand, you make better decisions. You’re less likely to panic during market dips or overspend on impulse purchases.

Celebrating small wins is just as important. Paid off a credit card? Saved your first $1,000? Reached a retirement milestone? Acknowledge it. These moments reinforce positive behavior and keep you motivated. Financial progress isn’t always visible in dollar amounts; sometimes it’s measured in peace of mind, reduced stress, or increased freedom. The flywheel doesn’t care how fast you go—it only cares that you keep moving. Even tiny steps, taken consistently, lead to transformation.

Lasting financial strength isn’t about one big decision. It’s about never stopping the process. It’s about choosing, day after day, to save a little more, spend a little wiser, and learn a little deeper. Over time, these choices accumulate into a life of security, choice, and confidence. The goal isn’t perfection—it’s persistence. And in the end, that’s what creates wealth without the waves.